Fractional Reserve Banking Is Pure Fraud: Indebting Iraq Financial System By Rothschild & J.P. Morgan. http://politicalvelcraft.org/2015/11/24/fractional-reserve-banking-is-pure-fraud-indebting-iraq-financial-system-by-rothschild-j-p-morgan/

Fractional Digital Reserve Banking Fraud. 100+90+81=

Mathematically-based principles are often illustrated best through use of an extreme, numerical example. We have no need to construct any hypothetical extremes, however, when we already have real-life insanity, in our current monetary/regulatory framework.

![Central Bank of Iraq finalises agreement with Zaha Hadid Architects to design new office headquarters in central Baghdad The Central Bank of Iraq on February 2 signed an agreement to begin the process of building new headquarters on the shores of the Tigris River in Baghdad. "The new building shall be a symbol of the [central] bank's role in the economic development of Iraq and a reflection of the determination to rebuild the country,"](https://rasica.files.wordpress.com/2015/11/screen_shot_2013-11-14_at_11-18-36_am-jpg.png?w=547)

Central

Bank of Iraq finalises agreement with Zaha Hadid Architects to design

new office headquarters in central Baghdad The Central Bank of Iraq on

February 2 signed an agreement to begin the process of building new

headquarters on the shores of the Tigris River in Baghdad. “The new

building shall be a symbol of the [central] bank’s role in the economic

development of Iraq and a reflection of the determination to rebuild the

country.” The £630 million building will be built on a 20 hectare site

in West Baghdad, which was originally used by Saddam Hussein to partially construct a super mosque.

Here it is important to note that in order to conceal the fraud, crime, and insanity of our present system to the greatest degree possible, the bankers hide their dirty deeds within their own convoluted jargon. Thus presenting “fractional-reserve banking” to readers requires some brief investment of time in definition of terms, starting with this term, itself.J.P. Morgan was ‘granted’ the rights to, effectively, set up the Central Bank of Iraq in Dec. 2003:

Activist Post

- J.P. Morgan Chase was chosen by the Coalition Provisional Authority [CPA] to ‘set up’ the NEW Central Bank of Iraq [specifically, the Trade Bank of Iraq ].

- Take note how this TRADE BANK only became operational in December of 2003:

- Trade Finance. The Trade Bank of Iraq (TBI) was established in July 2003 to facilitate trade of goods and services to and from Iraq by providing irrevocable letters of credit.

- The TBI officially became fully operational in December 2003 and has a services contract with a multi-international banking consortium led by JP Morgan Chase.

- Since opening in December, the Trade Bank of Iraq has issued or has pending 183 letters of credit, totaling $708.9 million in imports from thirty-one countries.

- Letters of credit have been issued on behalf of Iraqi Ministries as well as several state-owned enterprises.

- In that capacity, Morgan was charged with developing the framework of collateralizing movable and immovable property for the nation of Iraq.

- The fact is that one of the largest derivatives facilitators [aka paper promissory notes aka fractional digital banking scheme] in the world is one of the principal architects of the Trade Bank of Iraq,

- plus it is also well-known that J.P. Morgan has a direct connection to the Rothschild banking dynasty ~~ a trend that is to be seen in virtually every central and major bank in existence across the planet.

Fractional-reserve banking evolved literally based upon the temptation of all bankers to perpetrate fraud. Empirically it has always been observed, down through the centuries, that under normal circumstances, only a tiny percentage of depositors will come to claim their cash/wealth at any one time.

Thus the temptation is for bankers to “lend” more funds than they actually possess, i.e. they are “lending” what does not even exist: “fractional-reserve banking” – the ultimate euphemism of banking and fraud.

IndebtingTo bring into debt; to place under obligation; — chiefly used in the participle indebted. [1913 Webster]

Iraq’s New Parliamentary Building ~~ She goes up ~ a vast new $1-billion parliamentary complex

in Baghdad. The well-known London-based, Iraqi-born architect Zaha

Hadid has been tapped to design a 2.7-million-square-foot building on

the 49-acre site.

Up until the false flag attacks by Israel, and Israel Firsters in the US government, on the WTC in New York on 9-11-2001, there were 7 countries left in the world who had not buckled to pressure, who had not resigned themselves to slavery under the Rothschild fractional reserve banking system. Those countries were Afghanistan, Cuba, Iran, Iraq, Libya, North Korea and Sudan. But Now There Are More!It goes without saying that anyone or any entity which endeavours to “lend” something which does not exist is perpetrating fraud.

But before examining this inherent fraud more closely, it is important to back-up, and look at the Law. Note that even when banks “lend” the money which they actually do hold on deposit (as trustees for the depositors) that this is already wholly/totally illegal.‘STAGNATION’A prolonged period of little or no growth in the economy. Economic growth of less than 2 to 3% annually is considered stagnation. Periods of stagnation are also marked by high unemployment and involuntary part-time employment. Stagnation can also occur on a smaller scale in specific industries or companies or with wages.In late 2012, supporters said the Federal Reserve’s third round of quantitative easing [printing currency either digitally or physically] was necessary to help the United States avoid economic stagnation.The central bank’s proposed asset purchases of mortgage-backed debt were expected to foster economic growth, bolster the housing market and improve employment prospects.The Fed also kept interest rates low as part of its plan to prevent stagnation.IT BECAME WORSE BY 2015

Gates Rothschild NWO

It is the crime known as “conversion”.

France ~ David de Rothschild

Criminal conversion:

A person who knowingly or intentionally exerts unauthorized control over property of another person commits criminal conversion.When your bank lends-out money you deposited, which it claims to be “holding” for you as trustee, does it seek your prior authorization before lending-out your property and thus putting it at risk? Of course not. The banks get around the naked criminality of their lending operations through general authorization.

In the small-print of any/all bank deposit contracts is a clause whereby the depositor “authorizes” the bank to lend-out their property to Third Parties.We therefore start with the basic fact, that “banking” as we know it (bankers taking deposits, and then lending those deposits) is literally institutionalized crime.

But “fractional-reserve banking” goes far beyond this original level of criminality.Not only are banks allowed to lend what they don’t own, they are allowed to lend what they don’t even possess – and by many multiples.

“Banking” is institutionalized crime. “Fractional-reserve banking” piles-on a systemic and enormous element of fraud: “lending” what does not even exist. But this isn’t even the most-shocking aspect of fractional-reserve fraud.

Rothschild Billionaire Mahafarid Amir Khosravi, executed In Iran For bilking money then buying Iranian property for Agenda 21

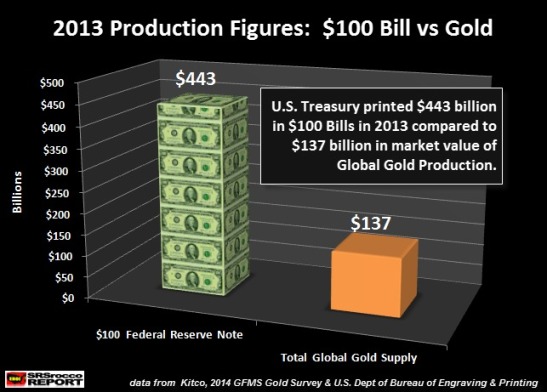

Suppose JPMorgan holds $1 billion in total deposits. In the original form of our fractional-reserve fraud, the fraud ratio was set at 10:1. This meant that for every dollar which a bank actually held, it was allowed to “lend” $10. Now the simple arithmetic.

JPMorgan is holding $1 billion of other peoples’ property, but it is allowed to “lend” a total of $10 billion. Where does the other $9 billion come from? It is literally conjured out of thin air , via fractional-reserve fraud.

Thus, for many readers, this represents their first, actual glimpse of the full fraud, and full insanity of our current monetary system.

In the original form of our “fractional-reserve” monetary system, for every $1 which our central banks officially printed, the banking system created an additional $9 out of thin air, via fractional-reserve fraud. Simply put; 90% of all the actual “money” in our monetary system, and our economies, was conjured out of thin air , by private banks, via fractional-reserve fraud.

This is fractional-reserve banking, presented as the naked fraud that it is: bankers “lending” not only more than what they possess, but lending out “money” which grossly exceeds the amount of capital in existence. Conjuring oceans of paper out of thin air. It is inherently criminal. It is inherently fraudulent.

It automatically transforms our monetary system into an institutionalized Ponzi-scheme.

By definition, all “fractional-reserve banking systems” must automatically collapse – in a sea of fraud – if all depositors simply claim a tiny portion of their deposits, at any one time.

This is also known euphemistically as a “run on a bank”.

- US Banks Told To Be Prepared For 30-day Crisis ~ Rothschild’s Last Stand!

- Central Bankers & US Government Now Preparing For Dodd Frank Basel III Bail-Ins.

- McCain’s Deadlier Version Of NDAA Passed By Belligerent Senate In Preparation For Reset.

This is yet another banking euphemism where depositors are legally prohibited from taking possession of their own property. The most recent example of such financial oppression was in Greece .

How can governments justify such financial oppression? While it is never explicitly acknowledged, the justification is entirely singular: to prop-up a Ponzi-scheme. It thus becomes necessary for governments to abandon the Rule of Law, and legally prevent/prohibit their own citizens from taking possession of their own property – as the only means of preventing the complete implosion of that system. The epitome of a Ponzi-scheme.

Observe how totally perverted and totally criminalized is the current system of fractional-reserve fraud. The banks are legally allowed to commit the crime of conversion: “lending” what they do not own.

The banks are legally allowed to commit fraud: “lending” what does not even exist. But if/when Depositors seek to take possession of their own property; they are treated like criminals.

The bankers are granted absolute legal protection to perpetrate their fraud/crime, at the direct expense of the law-abiding citizens of that society.

- Iceland Sends 26 Corrupt Bankers To Prison.

- Iceland Follows President Jefferson’s Warning About Debt Load.

- Every Icelander To Get Paid In Bank Sale: 26 Bankers Behind Bars!

They were convinced to do so on the basis of the promise/guarantee of the bankers. The bankers promised that they would exercise the enormous, legal privilege which they had been granted by acting in a responsible manner, and doing nothing to jeopardize this institutionalized Ponzi-scheme.

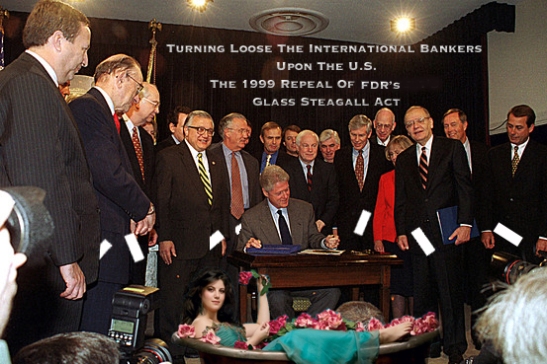

In reality; the banks have done the precisely the opposite. First the Big Bank crime syndicate had their servants in our puppet-governments tear-up the legal distinction between “banking” (institutionalized fraud) and “investing” ( institutionalized gambling ).

Overnight, our banks were transformed into bank-casinos.

Clinton’s 1999 Green Light For Banks To Make High Risk Investments Against The Middle Class!

The Big Banks literally “blew up” the Western financial system with their extreme, reckless gambling – gambling which began with the deposits which they claimed to be holding as trustees.

Instead of our governments punishing these Big Banks for their extreme, reckless fraud, they rewarded them. Using our money; these Traitor Governments indemnified the Big Banks for every cent of their reckless, fraudulent gambling. Then they did something much, much worse.

Our Traitor Governments bowed to the will of their banker Overlords, and dubbed these institutions of fraud/crime as being “too big to fail”. Translation? Instead of preventing these institutions of financial crime from continuing their reckless gambling, they promised to pay-off all of the banksters’ gambling debts, forever.

What happens when you tell any Compulsive Gambler that you will make-good on all of their gambling losses?

The Gambler runs wild. Observe what the banking crime syndicate calls “the derivatives market”.

It is their own private, rigged casino, where the total amount of ultra-leveraged betting is twenty times as large as the entire global economy .

Thus to go with the institutionalized crime and the institutionalized fraud of “fractional-reserve banking”, our Traitor Governments then added institutionalized extortion: allowing the Big Bank crime syndicate to blackmail our governments, in perpetuity, with the threat “bail-out all of our bad debts, or else…”

Following the Crash of ’08, and the literal sell-out by our own governments to the Big Bank crime syndicate; all of these Traitor Governments made the same promise to us: “never again.”

Supposedly, they would never again allow the Big Banks to blow-up our financial system, and to keep this promise, they all pledged “tough, new laws” – to restrain the reckless gambling of the Big Bank crime syndicate.

What these Traitor Governments actually did was the exact opposite of everything they promised. Instead of reducing and restraining the insane, reckless gambling of the bankers which led to the Crash of ’08, they institutionalized that, as well.

This will be the subject of Part II: taking a system which was already wholly criminal, ridiculously fraudulent, and completely unstable, and making it much, much worse.

The Daily Coin

No comments:

Post a Comment